We recently had the privilege of attending the Snowflake Data Cloud World Tour event in Austin, Texas. It was a full day of presentations, demos, and customer breakout sessions dedicated to discussing the technical and cultural challenges that organizations face as they strive to become more data-driven. Industry leaders who have harnessed the power of Snowflake’s data processing technologies and platform experts convened to shed light on the evolving landscape of data utilization and the critical need for businesses to adapt.

In today’s business environment, where access to data has reached unprecedented levels, success hinges not on the sheer volume of data you have access to but on how effectively you can leverage it to make informed decisions on an ongoing basis. In fact, research by Mckinsey & Company found that insight-driven companies report above-market growth and EBITDA (earnings before interest, taxes, depreciation, and amortization) increases of up to 25%.

Our most significant takeaway from the event was the pervasive sense of urgency, coupled with encouragement, that resonated throughout the sessions we attended. In the fast-paced world of business, staying ahead of the curve is imperative. The lifeblood of modern organizations is data, and if your company hasn’t already placed your first-party data at the forefront of your decision-making process, you risk falling behind. While it’s one thing for decision-makers to prioritize data, it’s another to instill a data-centric culture throughout your entire organization.

During the event, we heard from business leaders who recounted their early efforts to get their data houses in order. Some of these efforts date back to 2017 and 2018 when these visionaries recognized the transformative power of data and embarked on a strategic journey. Fast forward, as 2024 approaches, data isn’t merely a choice—it’s a necessity. If your organization hasn’t embraced a data-centric approach yet, the time to dive in is now.

Right after returning from the event, we received a timely report from Experian Research, focusing on the “Data Quality Revolution.” The message was crystal clear: if your business isn’t placing a strong emphasis on access to high-quality data, you should be, and the time to act is now. Continue reading as we explore the key takeaways from both the Snowflake event and the complementary Experian report.

The shift towards data-centricity: Where we stand

In the realm of data-driven decision-making, businesses are no longer tentatively testing the waters; they’re taking a deep dive. As highlighted in the Experian research report, “Over a third of business leaders say that better and faster decisions using data is a top priority to respond to market pressures. A continuous influx of accurate data enables team members—technical or not—to act with confidence. This is a claim that we see year after year and is vital in a market that is moving faster than ever.”

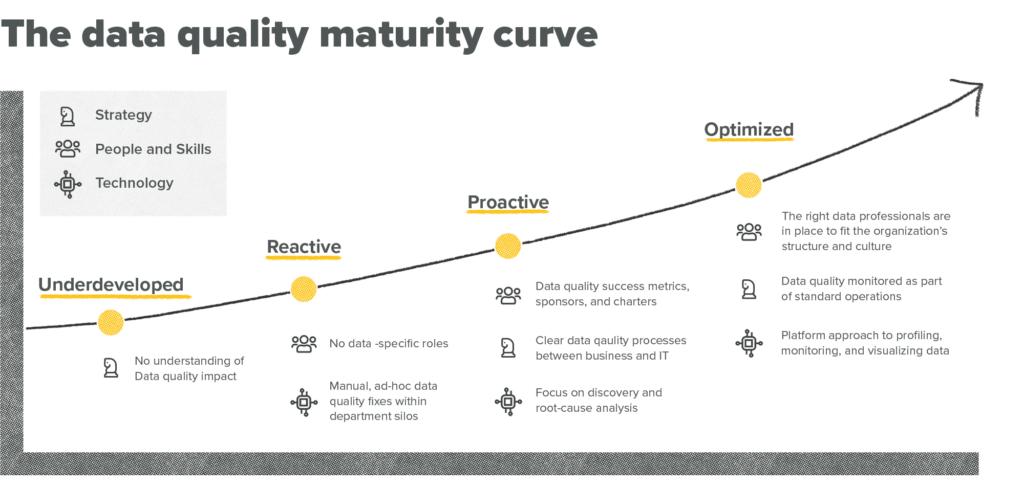

This sentiment echoes the progressive strides made by forward-thinking companies showcased at the Snowflake event. For instance, the Senior Director of Data Architecture, Engineering, and Platforms at a Fortune 500 athletic retailer shared insights into their innovative use of real-time data. By monitoring inventory levels and analyzing optimal pricing strategies in real-time, they’ve effectively maximized space utilization and ensured optimal profitability without compromising margins. This sophisticated approach underscores how organizations at advanced stages of data maturity leverage their data reservoirs to tackle genuine business challenges. Experian defines data maturity as “the extent to which your business can collect valuable data, derive meaning from it, and leverage this information in the decision-making process.”

Successful companies are often able to point to a mature data strategy that is disseminated throughout the organization that lends them a competitive edge. Consider Netflix or Amazon, for example. Both companies utilize their data to personalize content and provide product recommendations that increase customer satisfaction and ultimately drive greater customer engagement, retention, and overall revenue.

However, this level of sophistication isn’t universal. For numerous organizations, the journey along the data maturity curve is just beginning. Bridging the gap between recognizing the potential of data-centricity and effectively implementing it remains a common challenge encountered across various industries.

The challenges: Technical and cultural hurdles

One of the key challenges emphasized at the event was the demand for tools that can expedite the transition to data-centricity without subjecting organizations to extended development timelines. In today’s fast-paced business landscape, waiting months for development to design and implement complex systems is simply not feasible and leads to frustration throughout the organization.

What businesses need are solutions that are agile, efficient, and user-friendly. Experian “[s]urveyed businesses are looking at their technology to plan for scaling, expanding, and innovating data quality initiatives including easy-to-use tools for business users (50%).” The emphasis on user-friendly tools highlights a critical aspect of overcoming technical hurdles—providing accessible platforms that empower business users, regardless of their technical backgrounds, to harness the full potential of data, ensuring that the journey towards data-centricity is smooth and collaborative.

Learn more about building bridges between business and technology.

Embracing the potential, feeling the pain

Many organizations now find themselves at a crossroads—they’re acutely aware of the immense potential that a data-centric approach offers, but they are equally familiar with the growing pains that accompany this transformative journey. The heightened awareness of the benefits is juxtaposed with the acknowledgment of the challenges. This duality can be both motivating and overwhelming. The Experian research report echoes this sentiment, revealing a profound truth: “Year after year, we find that data investment equates to business growth. Our study shows that 95% of super performers—these high-achieving and data-mature leaders—believe that data quality is fundamental to business operations going forward.”

This statistic underscores the critical importance of data quality in the contemporary business landscape. It’s not merely a matter of investing in data; it’s about investing in high-quality, accurate data that can fuel informed decision-making and drive business growth. The realization that data quality is intrinsically linked to future success is a powerful motivator for organizations navigating the complexities of the data-centric journey. It signifies a shift in mindset from viewing data as a mere asset to recognizing it as a cornerstone upon which robust business operations are built.

While the challenges are palpable, so are the rewards. Embracing the potential of a data-driven approach means not only understanding the significance of data quality, but also taking proactive steps to address it. As organizations grapple with the intricacies of data utilization, this awareness becomes a guiding light, illuminating the path toward transformative change. By investing in data quality, businesses not only mitigate risks but also position themselves for sustained growth and innovation.

In this landscape of shifting paradigms, Tallwave stands as a strategic partner, ready to navigate the complexities of the data revolution alongside your organization. We offer tailored solutions designed to guide you and your teams to think through what data matters to your organization and build a culture that ensures your business is not just prepared for the future but actively shaping it. Let’s embark on this transformative journey together—where challenges become opportunities and data becomes the cornerstone of your success.

Tallwave: Your partner in the data journey

If your organization is ready to embark on the journey of embracing data-centricity but you’re uncertain about where to start, Tallwave is here to provide expert guidance. We know the intricacies of this transformation, offering expertise in both technical solutions and cultural adaptations across various teams in your organization. Our approach is tailored to your specific needs, ensuring a seamless integration of data-centric practices into your existing framework.

Ready to make the shift?

Don’t wait until you’re left further behind—take action now. Discover the business benefits, navigate the challenges, and transform your data potential into tangible results. Your journey toward a data-centric future starts today. We’re ready to lead the way.