2020 will go down in history as a year that vastly changed customer behaviors, expectations, and needs for good. And while that was bad for some industries and businesses, others whose products and services were ripe for digital-only and socially distanced environments saw major increases in customer acquisition, engagement, bookings, and overall sentiment.

For example:

- Companies like RVshare & Cruise America saw an 846% increase in bookings, as homebound individuals and families sought out adventure and reconnected to nature.

- Vacation and short-term rentals including AirBnb, VRBO, and AvantStay saw their numbers reportedly triple, and struggled to keep up with the demand.

- Subscription services experienced immediate growth just weeks into the pandemic, seeing monthly customer acquisitions increase as much as 85%.

- Grocery stores saw “double digit profits” compared to 2019.

- The pandemic reshaped the fitness landscape as health and fitness equipment revenue more than doubled from March 2020 to October 2020.

But, as the world returns to some sort of normalcy and consumers begin to venture outside their homes, pandemic-winning businesses are forced to answer the question: What strategies will help sustain recent customer acquisitions and growth? As consumers get tired of doing things they were forced to do during the pandemic, and a resurgence of options become available, pandemic-winning businesses will have to rethink the customer journey and uplevel experiences to avoid their recent success from tapering off.

Business who opt to maintain rather than innovate and improve customer experiences, risk being left behind.

6 Ways Pandemic-Winning Businesses Can Carve a Path Forward

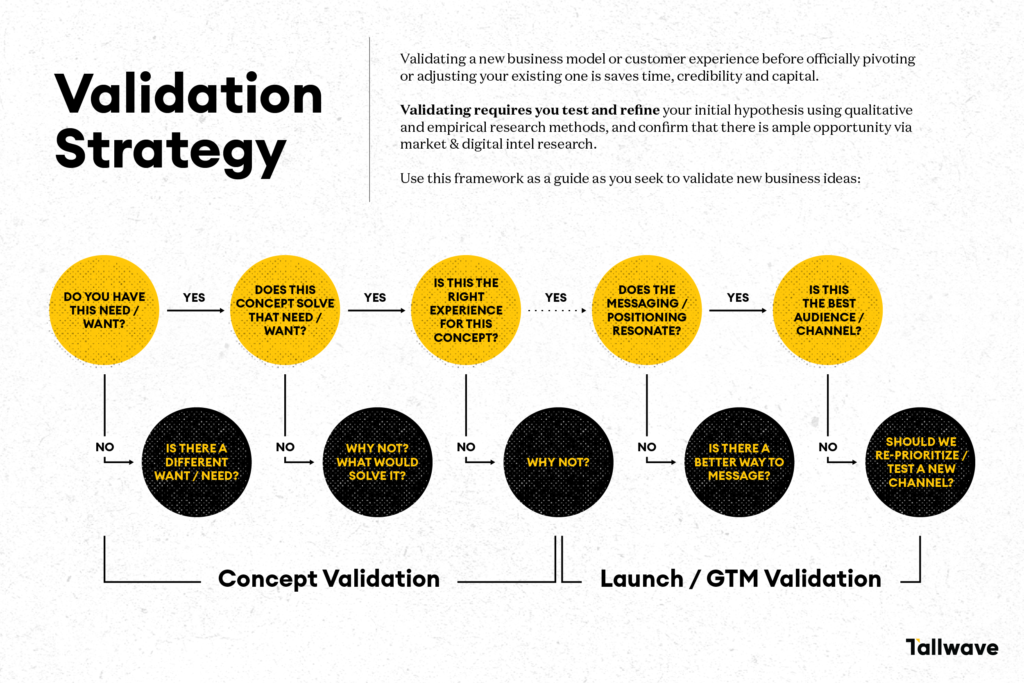

1. Identify Industry Changes & Trends That Will Continue Past the Pandemic

Understand what changed within your industry due to COVID-19, but more importantly, focus on identifying what the staying power of new and emerging trends really are. This will help ensure your business’s time, money, and energy is focused on creating change where it matters most, rather than reactively and wastefully catering to temporary trends that won’t drive long term ROI.

For example, according to an analysis conducted by the budgeting app TrueBill for The Washington Post, subscription boxes and services aren’t going anywhere. “Power subscribers” – consumers with 10 or more recurring payments that add up to an average of $145 spent per month – is growing exponentially. In fact, the subscription economy is predicted to grow by $1.5 trillion by 2025, says financial services firm UBS.

By understanding the staying power that subscription services have, you may be able to find ways to incorporate unique and convenient subscription-based experiences. Creativity is key. Take for example Tripadvisor. In an attempt to bounce back from hits the travel industry took during COVID-19, they’ve launched a $99 annual program that offers exclusive deals and dedicated service lines to subscribers as a way. Six Washington, D.C. restaurants found a way to play in the subscription economy by joining forces and creating a “supper club” that delivers gourmet meals prepared by different chefs each week to subscribers’ homes.

If there’s a will, there’s a way. And there’s a lot of money you may be leaving on the table if you don’t take time to identify trends that are here to stay.

2. Reevaluate Consumer Groups & Update Your Ideal Customer Profile

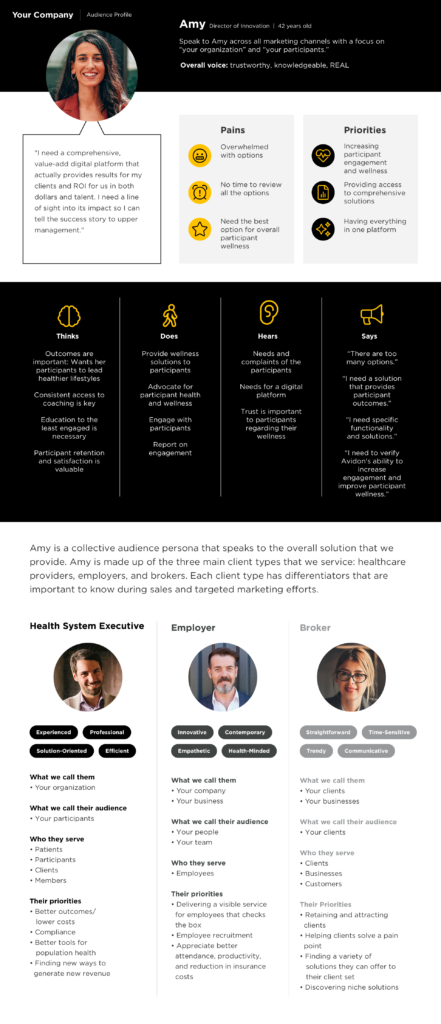

Consumer groups have inevitably changed, due to COVID-19. Whether it’s just the needs and wants of your existing customers that have evolved, or you find that a completely new customer mix now engages with your products or services, it’s crucial to understand exactly who you’re serving, and how you can create better experiences for them in the future. By gathering and mining audience data, you can uncover new behaviors and update your core personas and customer profiles to inform future customer experience design.

For example, the experience and relationship restaurant owners need and want from their produce suppliers changed due to the pandemic. As part of a larger customer journey initiative to better understand everyday business needs and experiences of existing customers, we created and executed a customer survey focused on 1-2 restaurant locations segments for a food distribution company. The intent of the survey was to understand unique attitudes and behaviors that could provide more opportunity to focus on increasing share and loyalty, and to further understand segmentation differences within customer groups. By gathering insights directly from our clients’ customers related to technology and tools, COVID-19 impacts and competition, and perceptions associated with our clients’ existing services, we were able to update attitudinal segmentation within their customer mix and uncover future opportunities for improved experiences.

3. Consider New Customer Behaviors & Usage

With limited options during the pandemic, many customers found new ways to use products and services than originally intended. For example, many rental homes that were typically reserved pre-pandemic for short-term vacations turned into long-term homes away from home. Cars that were previously used to get from point A to point B became safe-havens and temporary escapes for overworked parents. Video communication softwares such as Zoom, Google Hangouts and Skype evolved from connecting business colleagues to hosting virtual game nights, happy hours, and family celebrations.

As you mine audience data to uncover new and update existing consumer groups and personas, it’s also important to pay attention to how behaviors or usage shifted during the pandemic. Did customers engage with your products or services in new ways? Were they seeking new results or using your business to complete unprecedented tasks?

Use this information to expand the customer experiences you provide by designing, imagining, or inventing new uses for your product or service that provide added value.

Also read: 6 Factors Influencing Customer Behaviors in 2021 (With Original Research)

4. Pinpoint ‘Aha!’ Moments Within Your Customer Experience

The “Aha!” moment is when your customers truly “get it.” They understand the value that your product or service provides and realize why they need it – or simply want it – in their lives.

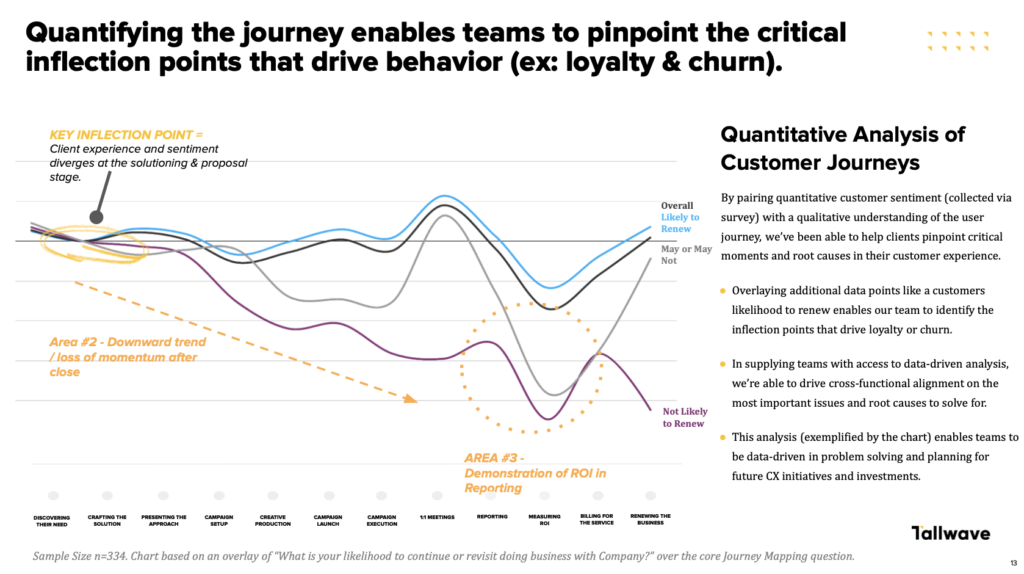

Evaluate and pinpoint where “Aha!” moments take place within your current experience by mapping the customer experience using both qualitative and quantitative research methods . Then, using the map, identify ways to either optimize, improve, or manufacture completely new “Aha!” moments to ensure continual value creation and engagement.

It’s important that customers perceive value at every stage throughout the customer journey to ensure repeat behavior. Don’t miss opportunities to drive an emotional bond and connection and establish a healthy customer-brand relationship by closing the loop too soon. The experience doesn’t end at the purchase point – the experience you provide creatively continue to drive value far beyond that.

Also read: 9 Quantitative Research Methods With Real Client Examples

5. Create New, Innovative, and Added Value For Customers

This is where we bring things full circle, and if you opt to maintain rather than innovate and drive your customer experience further, you’ll get left behind.

Through evaluating consumer groups and updating customer profiles, you may find that your business acquired new customers during the pandemic that wouldn’t have considered your product or services in a different time. As they start to return to pre-pandemic norms and habits, how can your businesses ensure you can convert newly acquired customers into repeat customers long-term? Well, using your customer experience map and analyses, look for ways to add value.

For example, new customers may not know how to use your product or service fully. If that’s not intuitive, you need to add value in the form of content (think opt-in texts, email nurture strategies, website quizzes and tools) or A.I. assistance to help customers use or leverage your product or services in new ways. By doing this, you can help educate consumers and push them closer to realizing value without selling them anything new.

Also, find ways to build community. Now more than ever, people are craving connection and want to support brands whose values align with their own and they can see themselves in. Consider connecting with and reaching new and existing customers by leveraging platforms such as Instagram, and TikTok to start conversations, allow people to attend offline events digitally, provide a look into your business “behind the scenes,” and more. The more authentic and human you can make your community and digital presence, the strong connection and support you’ll forge.

Also read: Developing Nurture Strategies That Decrease Time to Value

6. Help Customers Navigate & Transition Into a Post-Pandemic Landscape

Lastly, be helpful. This is just another version of value, but in this case, it’s selfless. It’s not about acquiring, upselling, or converting. It’s simply about doing what’s right and holding empathy for your customers by extending value beyond the reason people are (or were) forced to use your products or services during the pandemic.

Play a part in helping them navigate the bounce back to pre-pandemic life in a way that feels aligned with your brand but puts the wellbeing of consumers at the core.

Need help envisioning and implementing strategies to maintain success in a post-COVID world? We can help. Contact us today.