Quantitative research is essential to developing a clear understanding of consumer engagement and how to increase satisfaction.

Primary Quantitative Research Methods

When it comes to quantitative research, many people often confuse this type of research with the methodology. The research type refers to style of research while the data collection method can be different.

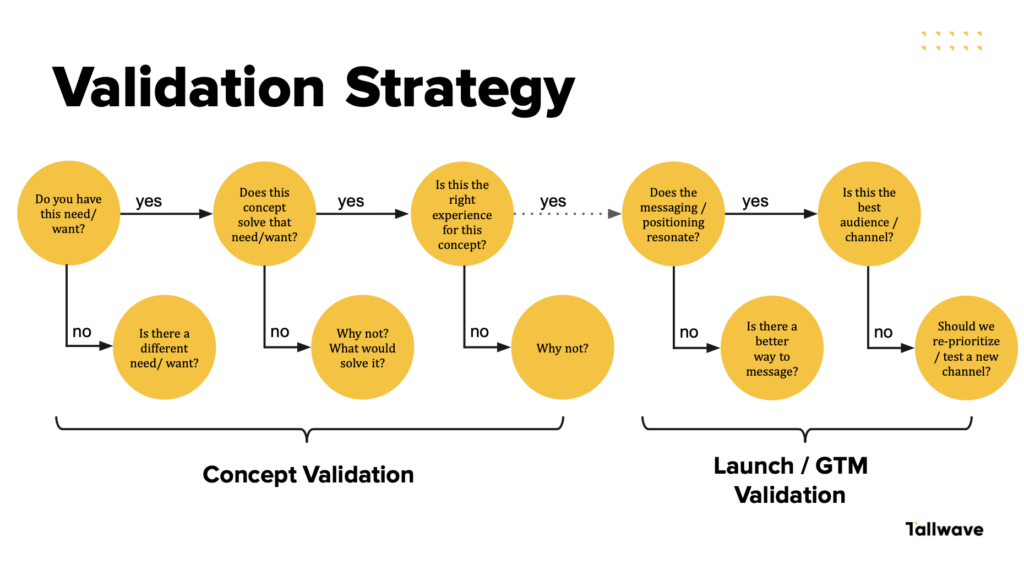

Research types

These are the primary types of quantitative research used by businesses today.

- Survey research: Ideally when conducting survey research businesses will use a statistically relevant sample to understand the sentiments and actions of a large group of people. This could be their current customers or consumers who fit into their ideal demographic.

- Correlational research: Correlational research compares two variables to come to a conclusion about whether there is a relationship between the two. Keep in mind that correlation does not always imply causation, which is to say you need to account for external variables that could cause an apparent relationship.

- Experimental research: This form of research takes a scientific approach, testing a hypothesis by manipulating certain variables to understand what changes this could cause. In these experiments, there is a control group and a manipulated group.

Also read: 6 Factors Influencing Customer Behaviors in 2021

Data collection methods

Launching the above research requires creating a plan to collect data. After all, quantitative research relies on data. Here are the common primary data collection methods for quantitative research.

- Surveys: A common approach to collecting data is using a survey. This is ideal especially if the business can obtain a statistically relevant sample from their responses. Surveys are often conducted through web or email questionnaires.

- Interviews: Yes, interviews can be used to obtain quantitative data. While this form of data collection is typically associated with qualitative research, interviewers can ask a standard set of questions to collate formal, quantitative data.

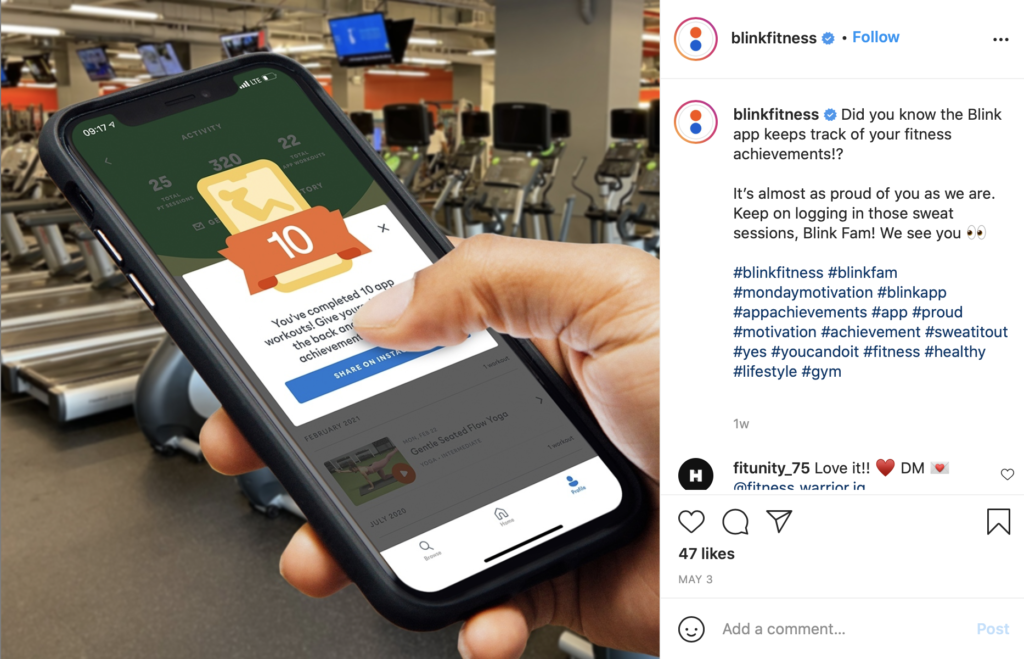

- Documentation review: With an increasing amount of business occurring digitally, there is more documentation now than ever before to help inform quantitative conclusions. Businesses can assess website metrics such as return visits, time on page or even use a pixel to track customer movement across websites. They can also view how many times their app has been opened and actions users have taken on their platform to determine customer engagement.

Secondary research can be helpful when formulating a plan for obtaining primary quantitative data. It can help narrow areas of focus or illuminate key challenges.

Secondary Quantitative Research Methods

Secondary data is information that is already collected and not necessarily exclusive to the company but still relevant when understanding overall industry and marketplace trends. Here are a few examples of secondary data:

- Government reports: Government research can indicate potential regulatory roadblocks, customer pain points and future opportunities. For example, a fitness company might use government data that shows an increase in use of outdoor running trials to develop a new product used to meet that specific use case.

- Survey-based secondary data: Polls or surveys that have been conducted for a primary use could be reused for secondary purposes. This could include survey data obtained by other companies or governments.

- Academic research: Research that has been previously conducted and published in peer-reviewed journals can help inform trends and consumer behavior, even if it doesn’t apply to a company’s specific customers.

Secondary research can be helpful when formulating a plan for obtaining primary quantitative data. It can help narrow areas of focus or illuminate key challenges. It can also help when it comes to interpreting primary data, especially when trying to understand the relationship between two variables of correlated data.

Also read: The What, Why, & How of Customer Behavior Analysis

Real Examples of Quantitative Research

We regularly use quantitative research to help our clients understand where they can best add value to increase customer engagement. Here are three examples of quantitative research in motion.

Example 1: Leading food distribution company

We helped a leading food distribution company identify changes in the needs and values of their restaurant clients as a result of COVID-19. This helped inform opportunities to become more valuable partners.

The research plan involved creating a survey that was emailed to clients. The questions were specific and numeric. For example, respondents were asked what percentage of their weekly spend was used with the food distribution company. They were also asked to assign a percentage to the way their food ordering had changed during COVID-19 and to rate their satisfaction with the food distribution company.

The results showed changes that had occurred for clients of the food distribution company as a result of the unique stressors of the pandemic. We were able to determine changes in weekly food supply and customer count as well as menu adaptations and purchase behavior.

Example 2: Leading credit card company

Our work with a leading credit card company required us to understand what current travel card members valued about the rewards program and their preferred communication method for booking travel in order to create an omnichannel servicing strategy and ideal customer journey.

Through an online survey of younger cardholders, the target demographic for this project, we asked questions such as length of card membership, total spend and the number of annual leisure trips in addition to more specific questions that showed how members get inspiration for trip planning and where they research.

The results highlighted ways to overcome resistance to pricing by proving more value. It also illuminated ways to make the benefits of membership more tangible to card holders and how to influence travelers in the early stages of planning their journey.

Example 3: Internal research report

We’re in the business of drinking our own champagne, so to speak, which is why we conducted our own quantitative research aimed at understanding the consumer trends that were spurred by the pandemic and how these will transform behaviors in the future.

There’s no question that new customer experiences emerged from the pandemic. Think of offerings such as “buy online, pickup in store (BOPIS),” or blended restaurant meals that are cooked at home. We wanted to understand how consumers truly felt about these new experiences and which they were likely to continue using even after restrictions were lifted. We also wanted to know more about the changing expectations for branded communication and how all of these pieces of the puzzle fit together to create consumer engagement. Our method of data collection was a survey.

Our research led us to develop insights we could use to inform our customers in their decision making. For example, we found convenience is paramount for consumers who are seeking out hybrid experiences such as BOPIS to take the best of both worlds. We also found many of these changes are permanent as consumers embraced new experiences that made their lives easier.

We regularly use quantitative research to help our clients understand where they can best add value to increase customer engagement.

The Bottom Line

Quantitative research is essential to developing a clear understanding of consumer engagement and how to increase satisfaction. Though online surveys are one of the most common methods for obtaining data, research isn’t limited to this strategy. It’s important to use whatever strategies are within your scope to constantly evaluate new trends and consumer behaviors that could significantly impact your offerings. The results can show you how to re-engage customers and drive loyalty.

Interested in partnering with us to learn more about your customers needs, wants, and behaviors to inform future experience design? Contact us today!