Many companies have shifted their focus to bottom-of-funnel tactics, like paid search and retargeting ads, as economic uncertainty drives budget constraints and increases the pressure to make sales. However, this imbalanced approach will almost certainly have a lagging negative impact on revenue and ROI.

Implementing a full-funnel marketing strategy can fix the imbalance and ensure long-term growth and sustainability. Let’s look at the full marketing funnel, why stage-specific engagement matters, and how to bring them to life.

What are the stages of full-funnel marketing?

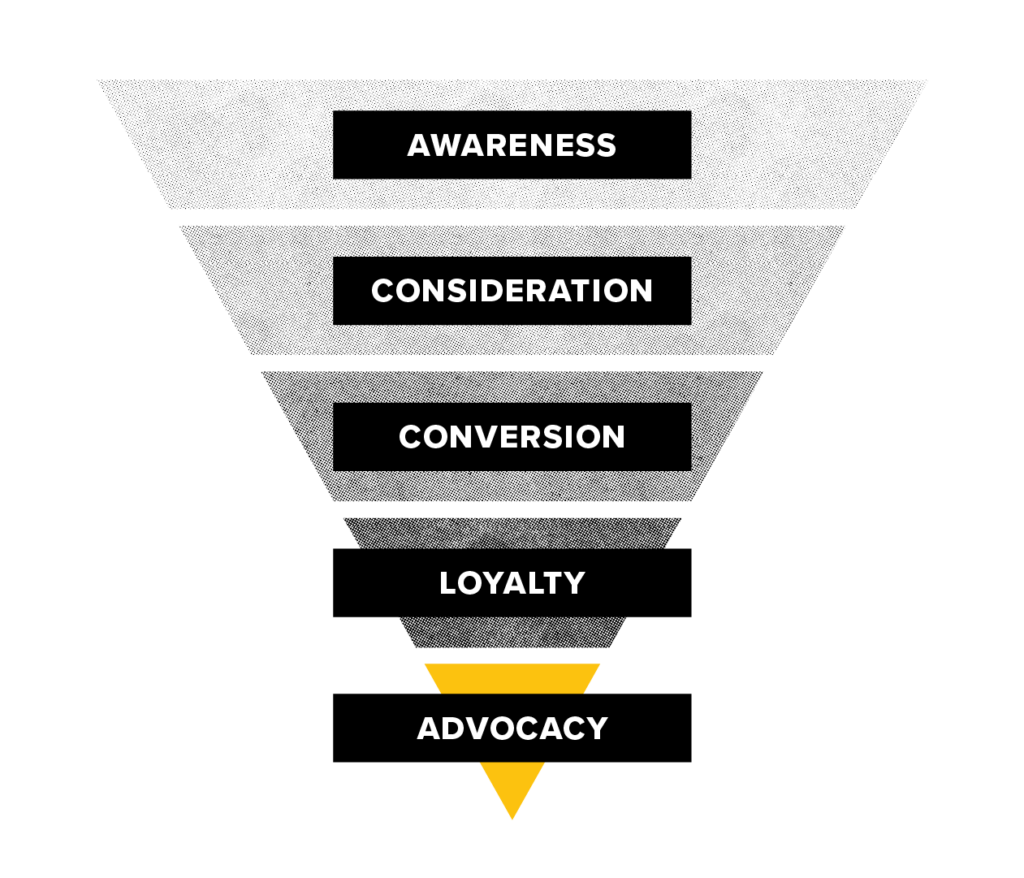

Marketing strategy is often compared to a funnel because of the shape it takes as consumers move through the purchase journey.

Stage 1: Top-of-funnel

Awareness tactics (at the top of the funnel) are broad and cast a wide net to reach consumers. This might include things like radio ads, billboard ads, blogs, or public relations campaigns.

The purpose of top-of-funnel tactics is to get your brand in front of your audience and generate brand awareness. As such, success for these individual tactics should be measured by publisher metrics like impressions, reach, frequency, and video completion rates or through survey metrics like lift in brand awareness and ad recall. A common misstep we see marketers make is trying to measure the success of a top-of-funnel tactic by the number of conversions it drives. Billboards aren’t going to result in a click-through conversion, but they do influence consumers who may not even know they want to buy your product or service yet. Similarly, an attribution model that ignores the role top-of-funnel tactics play as part of the confluence of factors that ultimately drive conversion can work against you.

Stage 2: Mid-funnel

Consideration tactics (in the middle of the funnel) focus on consumers who are familiar with and evaluating the brand. Tactics deployed at this might include product-specific emails, FAQ pages, and organic search strategy.

This is the stage where we start to see consumers interacting with the brand so success metrics look different than those in the top of the funnel. Here, we are interested in engagement metrics like click-through rates, social media interactions, rich media interactions, average time on site, pages visited per website engagement, scroll depth, and non-conversion website events (e.g., PDF downloads, webinar registrations, video completions, etc.).

Stage 3: Bottom of the funnel

Conversion tactics (at the bottom of the funnel) get in front of consumers who are ready to make a purchase. Paid search is a major tactic at this stage of the funnel, but tactics might also include website content like comparison charts or savings calculators.

This is the stage at which we measure tactical success in terms of conversions. Consumers, influenced by the awareness and consideration driven higher up in the funnel from other tactics, are now ready to make a purchase or submit a lead form.

But it doesn’t end there! After consumers convert, they move into the loyalty part of the funnel. The tactics in this part of the funnel keep consumers coming back. It might include things like personalized content, rewards and loyalty programs, or incentive campaigns.

The success of your loyalty program can be measured by customer retention rate, customer lifetime value, and repeat purchases.

The lowest part of the funnel is advocacy, which is all about getting consumers to tell their friends about your brand. This often takes the form of customer reviews and referral programs and can be measured by metrics like customer satisfaction scores, online reviews and sentiment analysis, and social listening insights.

Why does a full-funnel marketing strategy matter?

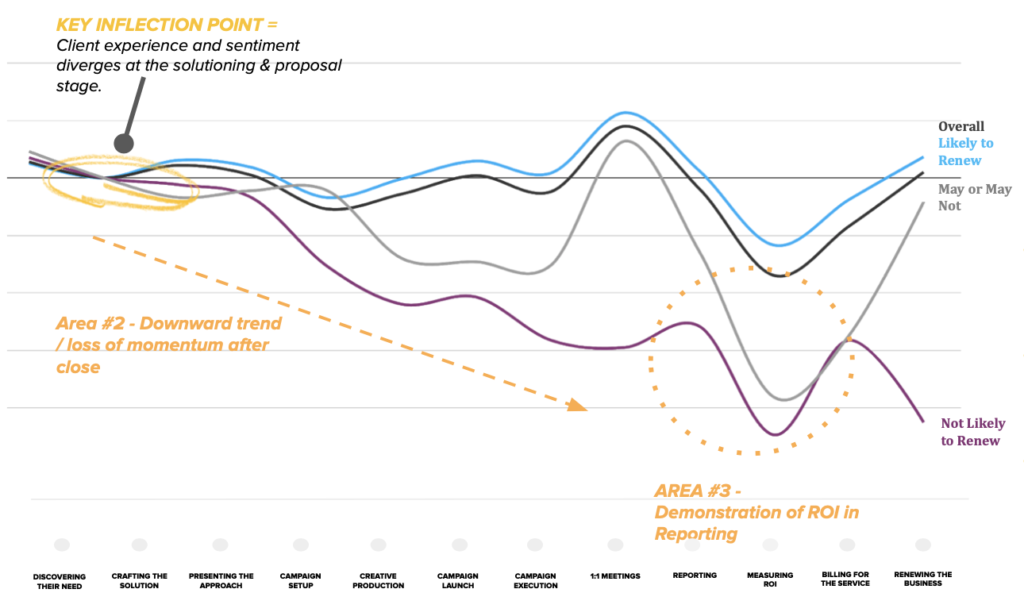

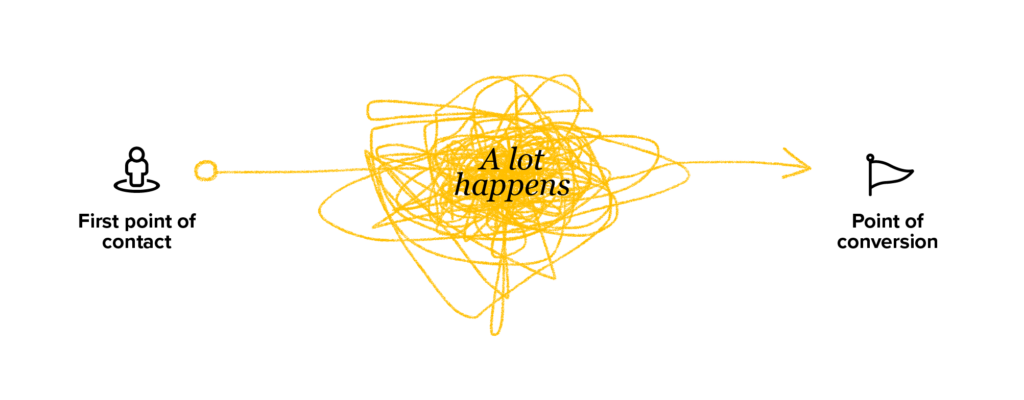

Although marketers like to position their strategy into a nice, neat little funnel, the reality is that the consumer journey is not so nice and neat. It’s also not linear. On average, it takes 8-12 touchpoints with a brand to convert a customer!

The beauty of a full-funnel marketing strategy is that it helps you meet consumers where they are in their journeys. It is a holistic, integrated approach that drives repeat exposure and facilitates multiple touch points with customers at different stages of their journey, which is critical for ensuring your brand is top of mind when the moment of truth comes and a buying decision is made.

The negative impact of a bottom-of-funnel approach

Conversion-focused tactics often get the most attention because they produce the most conversions. But consumers can’t convert if they aren’t aware of your brand. Consumers won’t convert if they know about your brand, but haven’t taken the time to consider what it means to them. By neglecting the upper parts of the funnel, you choke the funnel and restrict your ability to drive conversions in the long term.

Unfortunately, many companies get overly focused on the bottom-of-funnel tactics due to the very real and understandable pressure that marketers get from leaders focused only on transactional KPIs. This is especially true in times of economic uncertainty (check out our white paper on how to optimize your customer experience for recession resilience) when driving revenue takes on a heightened priority.

A broken funnel can manifest in many ways:

Poor engagement rates

If you skipped over the awareness part of the funnel, consumers may not be familiar with your brand. Trust and credibility have yet to be established and so they are not prepared to engage with your content.

High engagement, but low conversion

Similarly, if consumers are clicking, but not converting, may not be meeting them at the right point in their journey.

Conversion stagnation

Often a symptom of low-funnel strategies, you may have tapped out your available audience by ignoring critical awareness tactics.

Unintentionally over-indexing on first-time customers

It is 5-7 times more expensive to acquire new customers than to retain existing ones. If your customer base is over-indexed on new customers, you may need to double down on your retention efforts.

Decrease in branded searches

Customers can’t search for you if they don’t know about your brand. Investing in top-of-funnel tactics is crucial to driving brand awareness.

Increase in costs to convert

Persistent increases in cost per lead (CPL) or cost per acquisition (CPA) signal that you are competing for a finite, over-indexed audience and would benefit from upper-funnel tactics.

Bringing a full-funnel marketing strategy to life

If any of the scenarios above sound familiar, it’s probably time to evolve your marketing strategy to adopt a full-funnel approach.

Here are some key considerations when establishing a full-funnel marketing strategy:

Teamwork makes the dream work

A full-funnel marketing strategy requires collaboration across multiple teams (think strategy, brand, paid media, creative, content, design, PR, email, loyalty… the list goes on!) to ensure thoughtful, cohesive customer experiences. Make sure you are pulling in representatives from all the appropriate teams to drive alignment and ensure consistency.

Measurement matters

An appropriate measurement strategy is key to keeping a full-funnel strategy on the rails. As we described when defining the stages of the funnel, KPIs must reflect where tactics sit within the funnel to properly measure success and make informed marketing decisions.

Similarly, an attribution model can make or break your strategy. Last-click attribution models in particular can influence over-indexing on bottom-of-funnel tactics by assigning credit to the last touch before a conversion. This model puts a thumb on the scale for bottom-of-funnel tactics, limiting the ability to optimize for the distinct goals of tactics that play other roles in the funnel. Linear or data-driven models are generally more effective at assigning appropriate value to tactics throughout the funnel.

Be patient

The impact of a full-funnel strategy won’t be felt immediately. Upper-funnel efforts build future demand. Building loyalty and driving advocacy takes time. But this strategy sustains growth marketing investment in the long term by allowing you to reach more potential customers, extending the lifetime value of those customers, and generating more profit for less investment by driving efficiencies across the program.

The bottom line: full-funnel marketing strategies work

A recent Nielsen study of CPG brands showed that those with a full-funnel strategy had 45% higher ROI and a 7% increase in offline sales compared to marketing campaigns running in a single purchase stage.

We recently published a case study about how we helped a nonprofit client of ours drive efficiencies in their paid media program by enhancing their bottom-of-funnel paid media program to a full-funnel one. In the first year of running this full-funnel program, our client spent 9% more on paid media year over year, but produced 61% more donations.

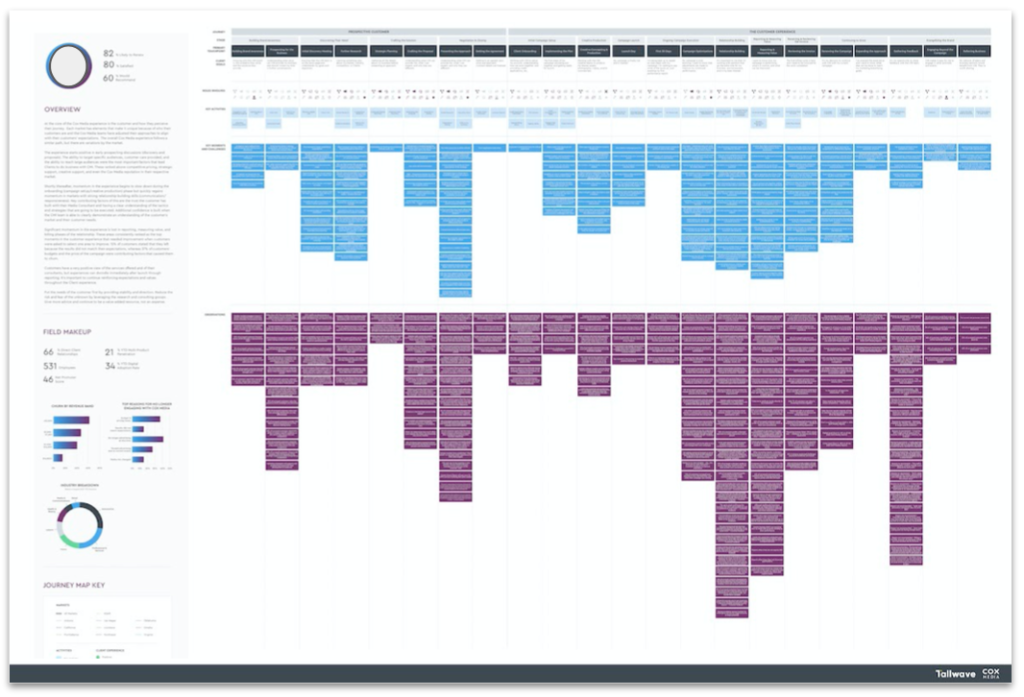

Designing holistic customer experiences that drive growth is our strength. Because full-funnel marketing strategy is a team sport that requires participation from multiple teams, internal silos are the enemy of creating a holistic, integrated strategy. At Tallwave, we pride ourselves on two things: 1) relentlessly keeping the customer at the center of what we do at every stage of the journey and 2) driving integration and collaboration in the strategies that drive the customer experience so we can deliver successfully against your customers’ needs and your business goals.

Ready to learn more about how Tallwave can help enhance your marketing program? Give us a shout!