Target audience research and persona profiles have become a standard part of the marketing toolkit. Despite the changes I’ve experienced in my 20 years as a marketer as new technologies have emerged, channels have evolved, and customer expectations have become more demanding, the importance of persona profiles has been one of the few constants. A rich persona can be hugely beneficial in driving and informing how we engage with prospective customers, certainly through marketing efforts, but more broadly as well.

Despite the rapid rate of change that has shaped the marketing landscape, how we approach persona profiles hasn’t changed all that much. I’ve seen personas with different levels of depth and layouts, but they’re generally pretty similar at their core. Most of the time, they include a combination of what your audience looks like, with details like their age, income, job title, and marital status. The more creative ones even include fictitious names and pictures. And the rest is some combination of consumer behaviors, statements, pain points, and information gathered from a fairly small number of representatives of your audience, often through interviews.

But there’s one big problem with the traditional approach to personas. Nearly all the information they include has very little to do with what you care about most: WHY your customers buy and HOW to get prospective customers to do the same. The good news is we believe we have a better approach. In this post, I’ll share a method for audience research and persona development that taps into a huge repository of existing data to deliver insights on the values that drive your customers’ decisions.

Why Values Matter for Driving Consumer Behavior

Roy E. Disney, nephew of Walt Disney and longtime senior executive for the Walt Disney Company, put the power of values into the most succinct statement I’ve seen yet: “When your values are clear to you, making decisions becomes easier.” He understood that, just like our customers, we make decisions every day, not based on our demographics or our past behaviors, but on our values. And brands can tap into that power. If you know which values your best customers share, the values that motivate the buying behaviors you’re trying to inspire in prospective customers, you have the power to know what to do and say to get existing customers to say yes more often and to drive new customers to purchase.

The Disconnect between Values and Demographics

As it turns out, our values have little to do with our demographics. Our demographics might be part of the reason we don’t take a particular action. For example, odds are if I don’t have children, I’m not searching for pediatricians or childcare options. Being childless, which is part of my demographics, is the reason for my inaction. But for people who share the demographic condition of parents, that common characteristic only determines that searching for and selecting a pediatrician or a childcare option is a choice they’re likely to make. The demographic condition of being a parent has nothing to do with which choice they make and why. If it did, all parents would make the same choices. But of course, they don’t. They make different choices based on what they value. That’s why using demographics alone to connect with and influence your audience doesn’t really work.

I think the values gap that exists within a traditional demographic and psychographic approach to audience research and persona profile development is something that most marketers recognize intuitively. But there haven’t been a lot of better options for uncovering the nuances of what an audience values in a scalable way. That is, until I listened to episode 331 of the Digital Marketing Podcast, The Death of Demographics, An Interview With David Allison. In it, David Allison talked about his book, The Death of Demographics, and the research data behind it that spawned the first big data tool that makes a scalable, data-driven approach to values-centric audience research and persona creation possible.

The book is the product of a massive global research study known as the Valuegraphics Project (more on that in a minute) that finds that when it comes to values, humans agree about 8% of the time as a baseline. When you group by any demographic cohort—age, gender, income, marital status, you name it—that agreement only increases by 2.5%. So building a marketing campaign around what you think “Gen Z” or “working moms” or “retirees” care about is going to be only slightly more effective than throwing the spaghetti at the wall and deploying your campaign to anyone and everyone. Because while the year you were born, whether you have kids, and your employment status may influence decisions you will or won’t make, they don’t have anything to do with the “why” behind them.

So what will be more effective? The answer is valuegraphics.

The Valuegraphics Project

The Valuegraphics Project is a global mapping of core human values, the drivers behind all our decision making. Through nearly a million surveys deployed in 152 languages in 180 countries across the world evaluating 436 values-related metrics, 56 core human values emerged. And 15 statistical clusters of agreement around subsets of those values, which the architects of this project call “archetypes,” emerged from that research data. Those 15 archetypes can be used as the basis for valuegraphic personas, each representing an audience that is demographically diverse, but highly aligned on values.

So building a marketing campaign around what you think “Gen Z” or “working moms” or “retirees” care about is going to be only slightly more effective than throwing the spaghetti at the wall and deploying your campaign to anyone and everyone.

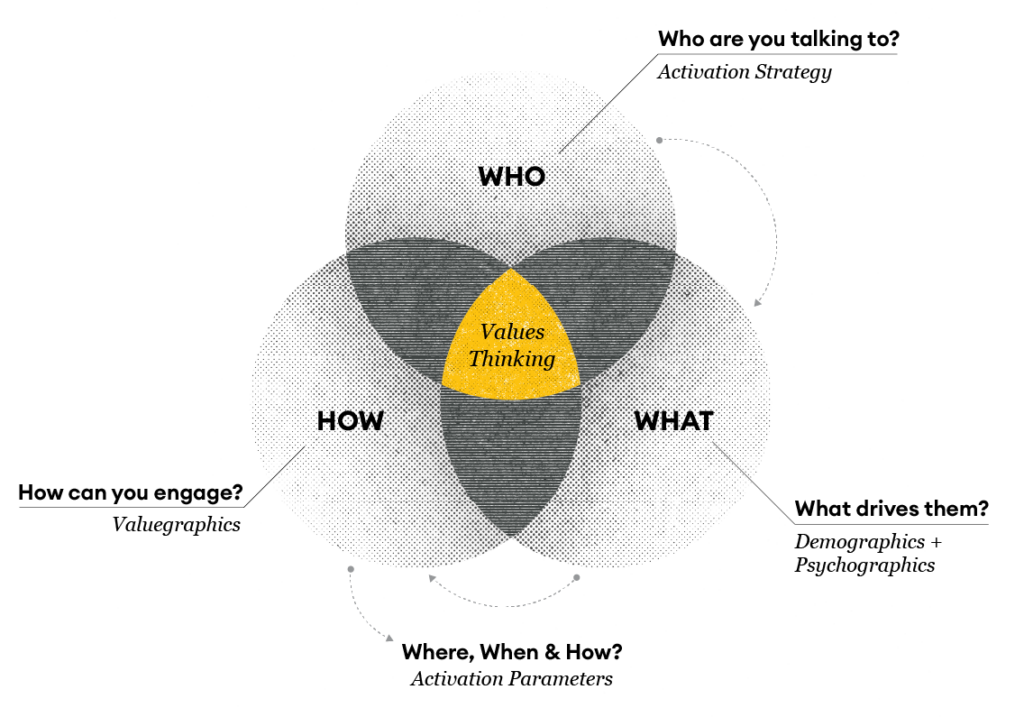

This focus on values doesn’t mean demographics and psychographics don’t have a place—they do. They can be practical and effective ways to limit your audience based on functional barriers to making the decisions you want them to make. But demographics and psychographics won’t help you understand what actually drives those decisions. You need valuegraphics for that. That audience data triad of demographics, psychographics, and valuegraphics all come together with your audience engagement strategy in the Value Thinking process.

Valuegraphics in Action

So how do you go about putting valuegraphics to work to better understand and engage your audience? It starts with understanding the valuegraphics profile for your target regions and then surveying your target audience to illuminate their dominant and least dominant valuegraphic archetypes.

Regional Valuegraphic Profiles

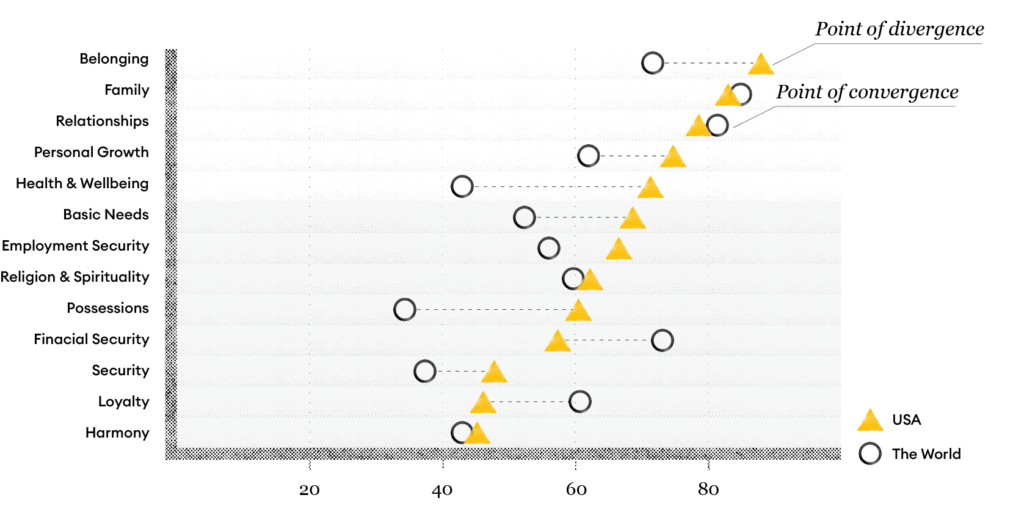

One of the outputs of the Valuegraphics Project is a set of region-specific profiles that tell you the top values for each region. Looking at the regional valuegraphics profile for the US, we know that belonging, family, relationships, personal growth, and health and wellbeing make up the top 5 values for the region. Looking at the top 5 values for the US compared to the rest of the world, we see that family and relationships are valued similarly. But there’s significant divergence between the US and the rest of the world when it comes to belonging and health and wellbeing.

If you’re targeting a US-based audience, that’s already much more useful than any demographic or psychographic data when it comes to not just getting in front of, but influencing your audience to take a particular action. No matter what else you say, if you can connect your product or service to the values of belonging and health and wellbeing, your efforts will be much more effective at striking a chord than they would be with demographic and psychographic data alone.

Valuegraphic Archetypes

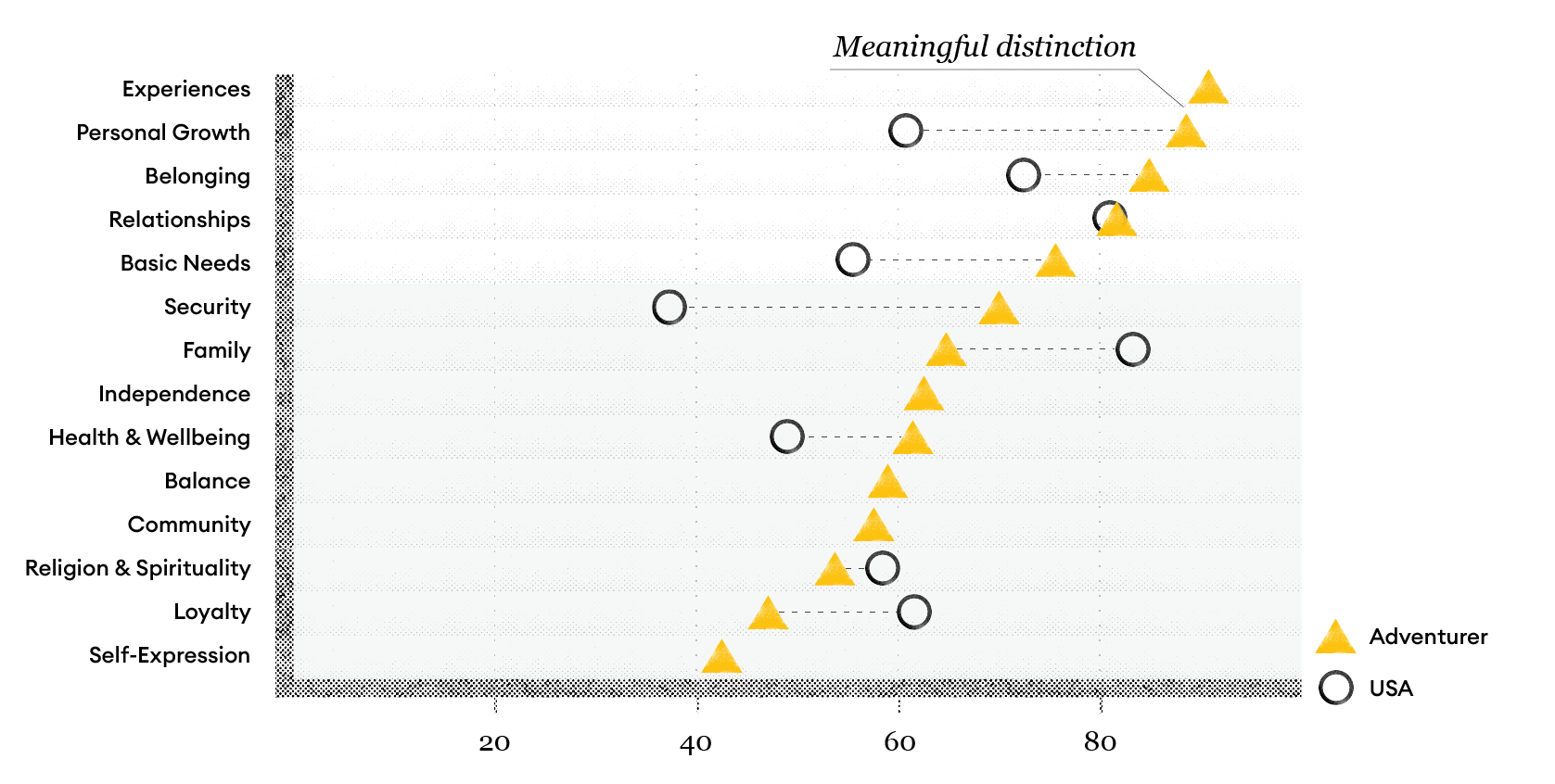

With the valuegraphic profile for your target region, you’re ready to uncover the most and least dominant valuegraphic archetypes of your audience. Let’s say you’ve surveyed members of your audience and determined that the dominant valuegraphic archetype among them is the Adventurer. This is the 7th most common archetype globally representing 10% of the population. So you’re already getting much more narrow than the regional profile. When you get down to archetypes and the values they contain, you’re tapping into a currency that not only drives human behavior, but drives it in remarkably similar ways for those who share these values.

Comparing the regional valuegraphic profile of the US with this specific archetype, two points of meaningful distinction in the top 5 values are immediately apparent. Experiences aren’t in the top values for the region at all, so focusing on this value will be uniquely resonant to this group. Personal growth is in the top 5 values for the region, but it’s ranked much higher for this particular archetype. Tapping into these values will create an engagement strategy that’s uniquely relevant for this specific audience. So in this example, we’ve deployed a valuegraphic survey to the kinds of customers we want to find more of. And in analyzing that data, we uncovered the Adventurer as the dominant archetype. How do we get from here to a values-driven persona that marketing and other teams within our business can sink their teeth into?

Building a Better Customer Profile: Valuegraphic Personas

We’ve taken this process one step further to create personas based on the valuegraphic profiles we’ve built around specific audiences. One of the first things that makes these personas stand out from the traditional fare is what they don’t include. What you won’t see in this kind of persona are the demographic elements you typically see (a picture, fake name, age, and bio). That’s by design because they generally have nothing to do with the action we want to compel. And including them can imply that they do. Best case scenario, it’s not helpful. Worst case scenario, it can cause us to arbitrarily limit our audience and cut us off from engaging with values-aligned prospective customers.

Here’s what you will find in one of our valuegraphic personas:

- The valuegraphic archetype(s) represented and a brief description of it, including contextual statements from people who share the archetype(s)

- Statistics on how common this persona is in your region and their degree of values alignment

- Highlights of the most and least dominant values, which serve as driver and detractor values respectively

- A list of qualities and characteristics that are virtually certain (in that they’re true for 90%+) and highly likely (75-89%) to be shared by people who represent the persona and implications for your brand

The information in the first three bullets helps us start to get inside the minds of this persona. But the last bullet contains the gold nuggets that have actionable impact on marketing and beyond. The certainties and likelihoods for valuegraphic personas cover broad and sometimes unexpected ground, from unique perspectives on values to common behaviors and preferences related to travel, mobility, money management, leisure, the list goes on. And they can inspire insights that can influence everything from product and service innovation to content and creative, targeting, affinity and partnership marketing, and more. And these insights aren’t the product of a handful of qualitative interviews; they’re the product of a massive global research study that included analyses on massive quantities of research data at a level of statistical rigor that would exceed the requirements of most major universities.

Beyond B2C: The Value of Valuegraphics for B2B Brands

It’s easy to see how a valuegraphics-based approach to target audience research and persona profile development applies to B2C companies. But the applicability to B2B companies might not seem as obvious because in these scenarios, we tend to adopt an institutional view of our buyers. In reality, purchase decisions for businesses are still made by human beings (and in most cases, multiple human beings). That means that not only is the concept of connecting with the values of your buyers still very much in play, one could argue that the impact is compounded given that purchase decisions are made by multiple decision makers. So if you’re engaging in a way that’s not aligned to your target audience’s values, you’re going to hit the same snags over and over again with multiple decision makers.

In the context of the traditional approach to target audience research for B2B companies, it would be typical to develop buyer persona profiles for the different stakeholders who play a role in making purchase decisions and develop distinct persona-specific value propositions for those different decision makers. In the context of valuegraphics, the same logic holds. Illuminating the values that drive decision making for your cadre of B2B buyers will make you more successful in aligning to those values and compelling the desired action.

Evolving Your Approach to Understanding and Driving Consumer Behavior

With the execution of the Valuegraphics Project, we now have a way to leverage a much bigger body of data in the art and science of developing persona profiles. As marketers and growth drivers for our businesses, that gives us the ability to develop a deeper understanding of our audience at scale and parlay that understanding into action both within and beyond our marketing strategies to align better, resonate more, and compel action more effectively. As the world around us grows increasingly privacy-sensitive and the data at our disposal to drive reach with our audiences becomes more limited and nuanced, the brands who know their audiences best will have the greatest advantage.

If you’re ready to evolve your approach to target audience research and harness the power of valuegraphics data to drive your market engagement strategies, I highly recommend checking out David Allison’s book, The Death of Demographics. Or better yet, give us a call for the CliffsNotes and our playbook for putting it into action.